Stablecoin Exchange Balances Reach Three-Month Low

The balances of stablecoins, which are crucial for indicating investor sentiment, have fallen to their lowest levels in months, coinciding with Bitcoin’s drop to its yearly low.

The cryptocurrency markets are increasingly reflecting a diminishing appetite for trading among investors. On Monday, April 7, stablecoin balances on exchanges decreased to a three-month low. As reported by crypto analytics firm Nansen, this figure hasn’t been this low since January. Furthermore, both incoming and outgoing flows on crypto exchanges have decreased throughout April.

This decline aligns with Bitcoin’s (B) fall below $75,000, reaching its lowest point since early November. The persistent uncertainty regarding the impact of Donald Trump’s tariffs continues to exert pressure on both the crypto and stock markets.

In light of this, the data suggests a waning interest from investors in trading, as riskier assets become less attractive. The drop in stablecoin balances on exchanges points to diminishing liquidity within the crypto markets, potentially leading to further price pressures as traders await more advantageous entry points.

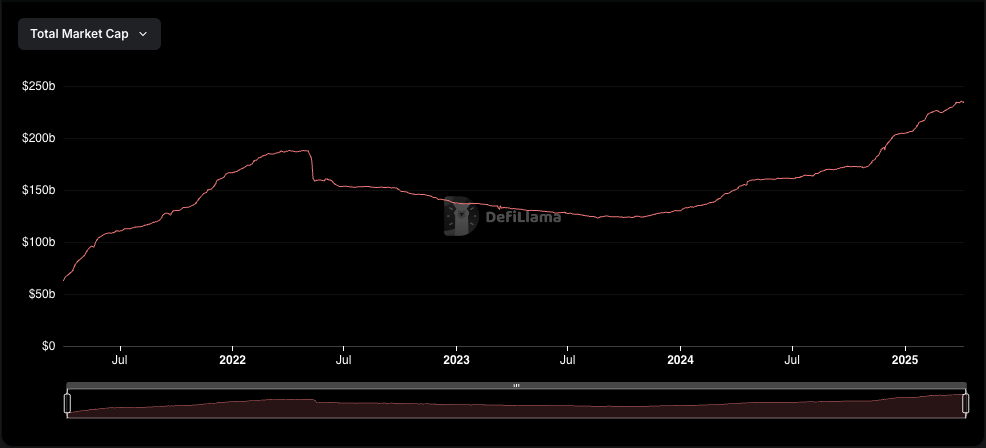

Stablecoin market cap continues to grow

Despite the decline in exchange flow, the overall stablecoin market capitalization has consistently increased in 2025. The total market cap rose from $203 billion at the beginning of January to $234 billion at present. This growth is likely driven by traders converting altcoins into more stable assets, a common practice during stressful market conditions.

Stablecoins are vital in the cryptocurrency ecosystem, serving both as a means of payment and a risk management tool. They tend to exhibit significantly less volatility compared to other digital assets, making them appealing during uncertain times. Their importance may further increase with the introduction of new regulations.

On April 2, the House Financial Services Committee passed the STABLE Act, which aims to enhance transparency and consumer protection for stablecoins by mandating that firms disclose their reserves.