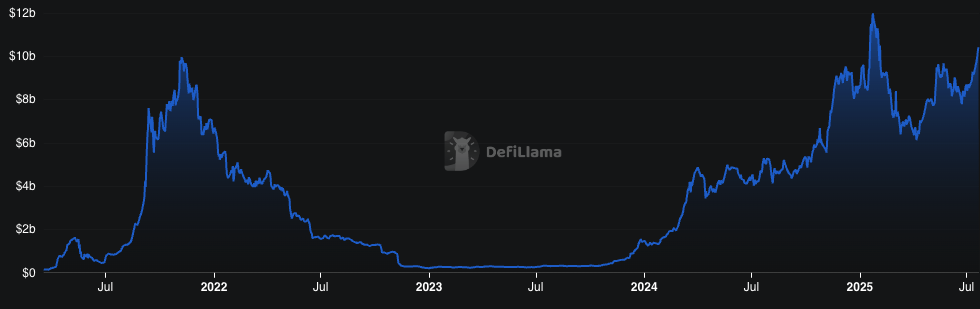

Solana’s DeFi TVL Reaches $10B, Marking a Six-Month High

The resurgence of Solana aligns with a notable rise in its DeFi TVL, achieving its peak in six months.

The recent crypto bull run propelled both Solana’s (SOL) price and its DeFi ecosystem. On Monday, July 21, Solana’s market cap exceeded $100 billion once again, with SOL trading at $194.62 per coin. Hovering below $105 billion, this marks the highest level this metric has reached since January 25 this year.

Additionally, the rise in Solana’s price has positively impacted the overall value of its ecosystem. Solana’s DeFi TVL has climbed to $10.453 billion, the highest since January, when SOL reached its all-time peak.

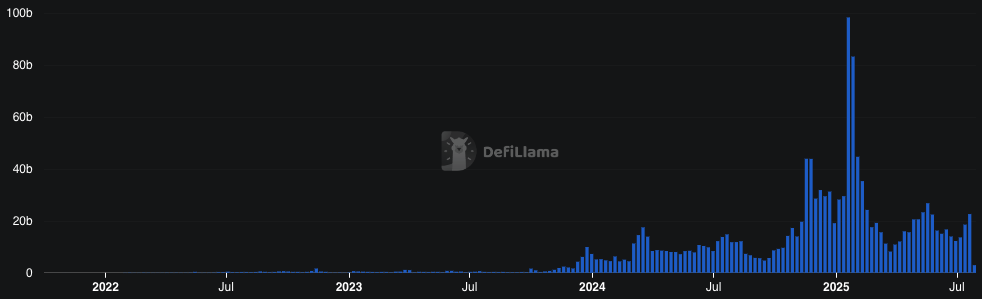

This growth is also evident in the surge of DEX activity, although these numbers have yet to match January’s highs. From July 14 to July 20, Solana DEXs recorded $22.58 billion in volume, an increase from the previous week’s $18.5 billion.

The leading decentralized exchanges include Raydium, Orca, and Meteora, with weekly volumes of $8.4 billion, $5.9 billion, and $5.3 billion, respectively. Nonetheless, weekly DEX volume is still far from the mid-January peak of $98.28 billion.

Reasons Behind Solana’s DeFi TVL Surge

The likely factor driving Solana’s DeFi TVL to a six-month high is the increase in the Solana token price. This is significant since SOL tokens represent a large portion of the assets held within the network’s DeFi protocols.

Solana’s DeFi TVL encompasses tokens, stablecoins, and memecoins deposited across various DeFi protocols within its ecosystem, including those in smart contracts, lending pools, and vaults.

However, the DeFi TVL does not encompass Solana tokens staked with validators for network security. Currently, this amount is 355.4 million SOL, valued at $69.44 billion, making up approximately 66% of all tokens in circulation. Additionally, DeFi TVL excludes tokens held on centralized exchanges.