How a Massive Copper Prize United Mining’s Underdogs

For years, the potential merger loomed in the global mining sector, yet remained elusive. In mid-2024, leaders at Teck Resources and Anglo American Plc began discussions about uniting their vast copper mines situated in the Atacama desert.

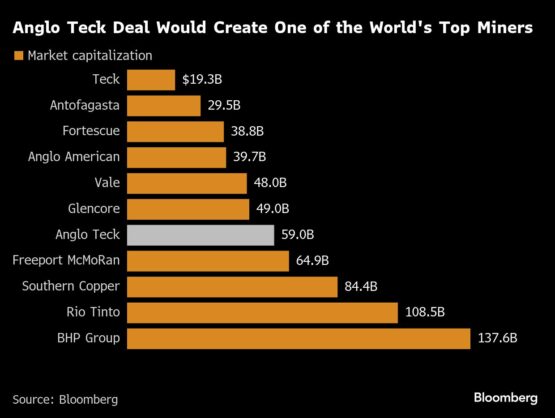

Those discussions culminated in a significant announcement on Tuesday: the two companies revealed a plan to merge not only their Chilean copper mines but their entire operations. This merger stands as one of the largest in the industry, creating a new mining powerhouse valued at over $50 billion.

Read: Anglo American agrees to acquire Teck in transformative mining deal

The rationale behind merging the Quebrada Blanca mine of Teck and Anglo’s 44%-owned Collahuasi mine was clear. Teck CEO Jonathan Price stated on Tuesday that the merger could forge one of the world’s most significant copper mines, particularly amidst rising demand for the metal, which makes the deal one of the “most compelling industrial synergies available in the industry today.”

Reaching the announcement on Tuesday involved navigating a complex array of challenges, including managing different personalities, political considerations, and debates over the new company’s headquarters, according to several insiders familiar with the negotiations, who requested anonymity.

The initial discussions began in 2023, when Teck was countering a hostile bid from Glencore Plc. However, the talks intensified in mid-2024 following Teck’s divestiture of its coal assets.

The companies first explored the idea of merging their Chilean copper interests, located only a few kilometers apart. Processing high-grade ore from Collahuasi at Quebrada Blanca could yield an additional 175,000 tons of copper annually with an investment of merely $1.9 billion, as per the companies’ estimates.

Read: Anglo American bids farewell to platinum

However, momentum picked up significantly in recent months. Anglo, entangled in its attempts to combat a hostile bid from BHP Group, had initially prioritized its own restructuring.

As time passed, the dialogue matured from a focus on just the Chilean assets to a broader viewpoint encompassing the entirety of Teck. Once Anglo finalized a spin-off of its platinum division in June, discussions accelerated notably, insiders revealed.

ADVERTISEMENT

CONTINUE READING BELOW

Price and Anglo CEO Duncan Wanblad developed a cordial rapport through discussions held during various industry conferences. There were also interactions between their respective chairs and dedicated internal teams.

Anglo American CEO Duncan Wanblad. Image: Ian Waldie/Bloomberg

Many negotiations took place within the offices of boutique investment banks that advised both parties, with Ardea representing Teck and Centerview aiding Anglo.

Wanblad remarked on Tuesday that there had been “sporadic discussions over the past year” regarding asset integration. “However, in the past few months, it became evident that combining the two businesses held significant value, in addition to the advantages derived from asset synergies.”

Despite several instances when it seemed discussions might falter, including days leading up to the announcement, both sides persevered — even amid operational challenges like the collapse of Anglo’s intended coal sale to Peabody Energy Corp. and issues at a critical Teck project.

Read: Anglo faces setback as Peabody withdraws from $3.8 billion coal deal

Anglo and Teck remained cautious to avoid obstacles that had hindered other major industry players from successfully navigating the acquisition of prized Chilean copper assets, insiders noted.

For instance, Glencore Plc — a shareholder in Collahuasi — initiated a bid for Teck in 2023 valued at $23 billion. However, its efforts fell through due to opposition from Norman Keevil, whose family has been associated with Teck for six decades and possesses controlling stakes through supervoting class A shares.

In contrast, during discussions with Teck, Anglo took care to obtain Keevil’s approval. Initially, both parties differed regarding the prospective headquarters for the merged entity, but they eventually agreed on Vancouver after Keevil expressed concerns over Teck relocating out of Canada. Preserving the company’s Canadian presence was paramount for the 87-year-old, who aims to cement his legacy.

ADVERTISEMENT:

CONTINUE READING BELOW

The Teck contingent also emphasized that the agreement should be framed as a “merger of equals” rather than a takeover. While Anglo shareholders will hold a majority stake in the combined company, with Anglo’s Wanblad at the helm, half of the board members will be nominated by Teck, and Teck’s chair, Sheila Murray, will retain her position in the new entity.

Keevil expressed his endorsement of the agreement, stating it represented “the merger of two respected, century-old firms into a world-class mining operation, situated here in Canada.”

Read: Anglo cuts dividend in light of unit sales

Anglo and Teck also gleaned insights from BHP Group’s failed $49 billion bid for Anglo last year. The South African government’s discontent over not being consulted contributed to BHP’s withdrawal from that deal.

To avoid similar pitfalls, Anglo and Teck kept essential governmental stakeholders informed throughout their discussions, including the prime ministers of Canada and the UK, Mark Carney and Keir Starmer. The merged company will maintain its primary stock listing in London, even if the headquarters is set elsewhere.

“The industrial rationale has always been evident,” remarked George Cheveley, a portfolio manager at Ninety One UK, which holds shares in both companies. “The more complex aspect of this deal has been orchestrating a seamless integration of the management teams and the companies themselves.”

Challenges may still lie ahead. Shareholder approval is required for the deal, and many industry analysts anticipate other firms could enter the bidding fray for Teck, Anglo, or both.

“Anglo and Teck have made the initial move,” asserted Tony White, partner at MKP Advisors, a merger arbitrage specialist. “However, the contest for control over these copper assets might not be resolved yet.”

© 2025 Bloomberg

Follow Moneyweb’s comprehensive finance and business news on WhatsApp here.