US Stocks Are Expected to Overcome Risks for Year-End Gains, Survey Reveals

According to the recent Markets Pulse survey, stocks are predicted to overlook inflation concerns and a deteriorating jobs outlook to finish the year positively.

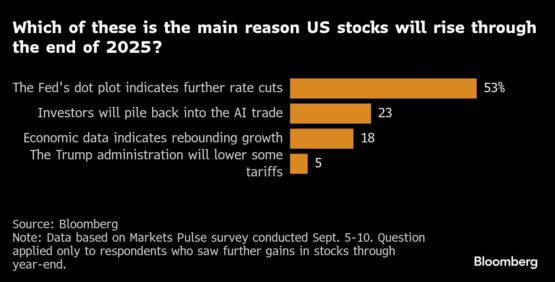

About two-thirds of the 116 participants in a poll conducted from September 5-10 believe the S&P 500 will keep climbing in 2025, with a majority expecting that gains will be spurred by signals from the Federal Reserve hinting at further interest-rate cuts before the year’s conclusion.

This week’s unexpected and significant preliminary markdown in payrolls caught traders by surprise, suggesting that average monthly job growth was potentially only around half of what had been officially reported through March of the current year.

Listen: US jobs data almost ensures a US rate cut

This data has introduced a degree of caution regarding the US economy, increasing bets on nearly three rate cuts this year, starting with the policy decision on September 17. It has also reignited discussions around a possible larger reduction of 50 basis points from the Fed next week.

ADVERTISEMENT

CONTINUE READING BELOW

“The argument holds as long as the rate cuts are minor and gradual. Wall Street would welcome that,” commented Matt Maley, chief market strategist at Miller Tabak & Co. “However, if the cuts are aggressive, it will indicate a significant slowdown in growth, which wouldn’t bode well for the current expensive stock market.”

Economic Concerns

JPMorgan Chase & Co strategists caution that the Fed’s upcoming decision could dampen investor enthusiasm, particularly if policymakers proceed with a widely expected interest-rate cut next week. This could echo last year’s scenario when policymakers reduced rates by 50 basis points, yet the S&P 500 dropped 0.3% that day amidst economic apprehension.

Nonetheless, traders are backed by historical data. Typically, when the Fed lowers rates, stock prices tend to rally in the following weeks and months, irrespective of the initial market response, as indicated by a Markets Live analysis.

However, economic uncertainties lingered in the survey’s backdrop. Fewer than 20% of respondents identified rebound economic data as a catalyst for stock price increases.

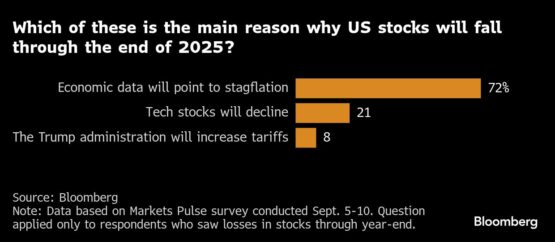

Among those forecasting a stock market decline for the remainder of the year, the threat of stagflation in the US overshadowed other concerns, such as a drop in tech stocks or rising tariffs under President Donald Trump.

“The economy is on the brink of a mild form of stagflation,” stated Michael Bailey, director of research at FBB Capital Partners. “I suspect inflation will remain slightly elevated in the low single digits, while unemployment will gradually worsen. However, true stagflation is dangerously close to a severe recession that’s challenging to reverse.”

ADVERTISEMENT:

CONTINUE READING BELOW

A Mixed Outlook

Currently, the data suggests an economy that is neither particularly weak nor robust. While job growth has stagnated and the housing market is struggling, recent economic surveys indicate improvements in both the manufacturing and services sectors.

Consumers appear to be faring well, especially as the expectation of rate cuts increases the likelihood of a soft landing — a favorable scenario for stocks.

“The equity market’s capacity to withstand weakness in the labor market depends on the monetary policy response being sufficiently significant to mitigate the growth risks,” analysts from Morgan Stanley, including Mike Wilson, noted in a recent report. “With the Fed still concentrating on inflation potentials and the labor data being weak but not critically so, there are uncertainties regarding how extensively the Fed can cut.”

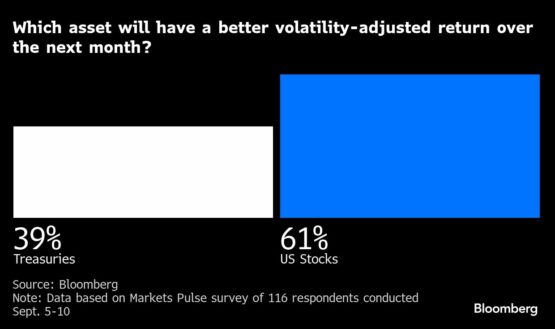

Equities are predicted to deliver better volatility-adjusted returns than bonds in the upcoming month, though survey participants are divided on whether 10-year yields will rise or fall in the near future. Nevertheless, most indicated that the yield curve is expected to steepen this year as long-dated Treasuries continue to be affected by inflation concerns, fiscal worries, and challenges to Fed independence.

© 2025 Bloomberg

Follow Moneyweb’s in-depth finance and business news on WhatsApp here.