Japan Tobacco Doubles Down on Budget Cigarettes

With their distinctly American branding, bright red and blue packaging, and affordable price point, Eagle 20s are a top choice for cost-conscious smokers in the U.S. When the value is this great, opting for American-made is a no-brainer, reads the slogan on their website.

“Customers who previously chose premium brands are now shifting towards more budget-friendly options,” states Gary Buchholtz, proprietor of the Twin Peaks Liquor store located in Longmont, Colorado. As economic strains and climbing prices pressure consumers within one of the world’s most lucrative tobacco markets, he’s observed an uptick in sales of discount brands, including Eagle 20s, Pyramid, and Montego.

Read: Market for illegal cigarettes hits unprecedented highs

All three brands are now under Japan Tobacco International’s umbrella following its acquisition of Vector Group for $2.4 billion in October. JTI then predicted that lower-priced cigarettes would represent over 40% of the U.S. market by 2027, an increase from approximately 32% in 2022.

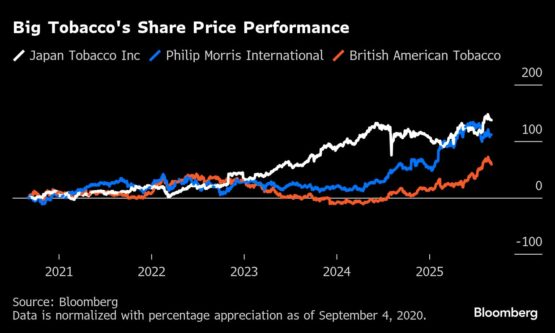

The Vector acquisition signifies that the world’s third-largest tobacco company is pursuing a different direction compared to its peers.

“It may not be a trendy perspective, but cigarettes generate substantial profits,” remarked Rae Maile, an analyst at Panmure Liberum, in a note from February. “JTI has been straightforward about this.”

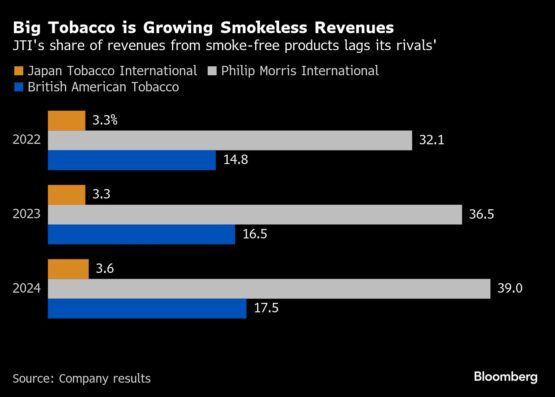

While competitors like Philip Morris International and British American Tobacco Plc have ambitious plans for “smoke-free” products—such as e-cigarettes, heated tobacco products, and nicotine pouches—JTI has concentrated more on traditional combustible tobacco products. This acquisition follows its purchase of the tobacco business of Bangladesh’s Akij Group in 2018 and Indonesian clove cigarette manufacturer Karyadibya Mahardhika the year prior.

JTI has also put funds into the Winston and Camel cigarette brands, which it markets outside the U.S., helping it enhance its share in countries like Germany, Spain, and Italy. The company has emphasized improvements in packaging, flavor options, and overall quality, according to a spokesperson’s email.

This strategy has proven effective. In 2024, the company saw a 2% increase in cigarette volumes, a 9% rise in revenue, and a 10% boost in profit.

A person using an electronic cigarette device at a smoke shop in New York. Image: Michael Nagle/Bloomberg

ADVERTISEMENT

CONTINUE READING BELOW

While experts note that smokeless products may pose fewer health risks compared to traditional cigarettes, they are not entirely risk-free. Nicotine is a highly addictive substance that is particularly dangerous for youth and pregnant individuals, as highlighted by the U.S. Centers for Disease Control and Prevention. Even though heated tobacco products might contain lower levels of harmful substances than combustibles, the agency emphasizes that there are “no safe” tobacco products.

Read: Sars confiscates illicit tobacco and cigarettes worth millions

Nonetheless, at a time when other tobacco companies are advocating for transitioning smokers to alternatives that are less harmful, JTI’s strategy may appear contentious.

Reduced-risk products

Philip Morris, the largest tobacco firm globally, has invested upwards of $14 billion in smoke-free alternatives since 2008. Although it acquired a minority stake in an Egyptian cigarette manufacturer last year, its goal is to derive two-thirds of its revenue from products like Zyn nicotine pouches and IQOS heated tobacco sticks—now exceeding Marlboro’s annual revenues—by 2030.

BAT, which owns Reynolds American Inc. in the U.S., aims for at least half of its revenue to stem from smokeless products by 2035.

JTI is also committing resources to “reduced-risk products,” which include its Ploom heated tobacco line and Nordic Spirit nicotine pouches—but at a more measured pace. Its newest offering, Ploom AURA, debuted in Japan in May and in Switzerland earlier this month. The company has a strategic partnership with Altria Group to commercialize Ploom products within the U.S.

Between 2022 and 2024, JTI allocated around ¥300 billion ($2 billion) to enhance its reduced-risk portfolio and plans to invest more than ¥650 billion between 2025 and 2027, as stated by a spokesperson, though no specific revenue target for smoke-free products was mentioned.

This strategy brings into question whether tobacco companies are adequately offering alternative products to consumers in emerging markets.

In Tanzania, where JTI holds a manufacturing monopoly, it markets six cigarette brands but lacks offerings for vapes, heated tobacco sticks, or other alternatives. This is a common issue; British American Tobacco Kenya, which dominates its market, previously only offered cigarettes before starting to sell Velo nicotine pouches in July.

“Cigarette companies have a responsibility to distribute European innovations into these regions,” remarked Shane MacGuill, leading tobacco research for Euromonitor International.

ADVERTISEMENT:

CONTINUE READING BELOW

“You can’t just provide choices where it benefits you,” he asserted. “You need to offer options to all consumers regardless of location.”

Hazel Cheeseman, CEO of Action on Smoking and Health, expressed her desire for emerging markets with rising smoking rates to implement more regulations to curb tobacco use.

“Evidently, JTI is betting on a different future,” she commented. “They envision themselves as a cigarette company in years to come.”

US Venture

Japan Tobacco was founded in 1985 and was state-owned until 1994. Currently, the Japanese government holds about one-third of the company. With annual sales of ¥3.15 trillion in 2024, it sold 541.9 billion cigarettes across 130 markets. The JT Group, which is the parent company of JTI, also engages in food and pharmaceuticals.

In 2007, JTI acquired British tobacco manufacturer Gallaher Group, expanding its footprint in the UK and broader Europe. Since then, it has purchased tobacco enterprises in countries like Sudan, Egypt, Iran, and Bangladesh. In 2018, it took over Russia’s Donskoy Tabak, pushing its market share in that nation to nearly 40%.

The company halted its investments in Russia in March 2022 but claims to still be the largest tobacco producer in that country by sales volume. Its significant markets include Italy, the Philippines, and Japan, where JTI holds a dominant share of the cigarette market.

In Japan, JTI is increasing prices for conventional cigarettes while pushing its heated tobacco products. Although Philip Morris’s IQOS currently leads the market, Ploom’s share climbed to 13.6% in the second quarter of 2025, up from 7.6% three years prior, based on earnings reports. Demand for tobacco and combustibles in Japan is expected to decline over the next five years, according to Tsukasa Furuta at SMBC Nikko Securities.

In the U.S., the acquisition of Vector has given JTI a strategic edge as smokers face inflation and increased taxes, while tobacco companies hike prices to compensate for reduced cigarette sales.

Since 2021, premium brands have steadily dropped in market share, decreasing from around 80% of tracked cigarette sales to about 70%, noted Connor Rattigan, an analyst at Consumer Edge.

“Unlike in the past, consumers are now less brand-loyal,” remarked Audrey Silk, a consumer advocate and founder of Citizens Lobbying Against Smoker Harassment. “They prioritize cost over brand allegiance.”

ADVERTISEMENT:

CONTINUE READING BELOW

BAT’s U.S. cigarette volumes dropped 10.1% last year, partly due to this shift. The company is piloting a more affordable version of its Doral brand in Louisiana and West Virginia “to understand these dynamics,” said CEO Tadeu Marroco in an interview. Altria, which has experienced a loss in market share to discount brands in the U.S., is launching a product priced at $5.10 per pack versus Marlboro’s $9.50, according to UBS.

International markets

In regions like Tanzania, JTI indicates its emphasis on traditional tobacco reflects its strategy for generating revenue through increased market share. “We are dedicated to monitoring trends and introducing our RRP where there’s consumer demand,” stated a spokesperson.

However, in Dar es Salaam, shopkeepers are noticing a growing trend of younger customers opting for alternative nicotine products.

“Many young individuals who visit my shop now prefer vapes over traditional cigarettes,” explained Zakia Jumanne, a cashier at a local supermarket. Their popularity is rising, even though they are relatively pricey, retailing for over 25,000 Tanzanian shillings ($10), while cigarette packs range between 2,000 and 6,000 Tanzanian shillings.

Shoppers Supermarket, one of the major retailers in the country, offers disposable vape brands such as Smok, Fire XL, Freshy, and Tugboat, along with vape refills from the Nasty Juice brand. Flavors like mint, watermelon, and peach are reportedly among the favorites.

Despite the global rise of alternative products, the conventional cigarette sector remains heavily regulated, stable, and profitable.

“Cigarettes are comparatively cheap to produce, and the consumer base is practically addicted to them,” elaborated Desmond Jenson, deputy director of commercial tobacco control programs at the Public Health Law Centre.

In his opinion, the reasoning behind acquisitions like JTI’s Vector purchase is straightforward.

“Why invest in expanding a sector of your business that focuses on the most harmful products?” he questioned. “The simple answer is that they are, by far, the most lucrative tobacco products available.”

© 2025 Bloomberg

Stay updated with in-depth finance and business news from Moneyweb on WhatsApp here.