Could the Crypto Crash Pave the Way for Bitcoin’s Next Major Rally?

Bitcoin is bouncing back after experiencing one of its most significant corrections this year, with on-chain data indicating that the recent crash may have laid the groundwork for a healthier recovery.

Summary

- During Friday’s crypto downturn, Bitcoin’s open interest plummeted by $12 billion, marking a substantial leverage reset.

- Crucial on-chain metrics, such as funding rates and the Stablecoin Supply Ratio, suggest sentiment is stabilizing and liquidity is increasing.

- Investment products in digital assets observed inflows of US$3.17 billion last week, with Bitcoin leading at US$2.67 billion, reflecting ongoing investor confidence.

On Friday, Bitcoin experienced one of its most drastic corrections in history amidst a market-wide downturn. A recent analysis by CryptoQuant noted that open interest dropped by $12 billion, from $47 billion to $35 billion.

The correction caused Bitcoin’s price to fall to approximately $102,000, significantly below its recent high of over $126,000, before buyers stepped in over the weekend to facilitate recovery. As of now, BTC has bounced back to around $115,117, showing over a 3% increase for the day.

Although the sell-off was challenging for many traders, it may serve as a necessary reset that could lead to long-term benefits. The analysis highlighted that funding rates, which turned negative during Friday’s sell-off, have stabilized to modestly positive levels, suggesting that sentiment is returning to normal as extreme bearish positions unwind.

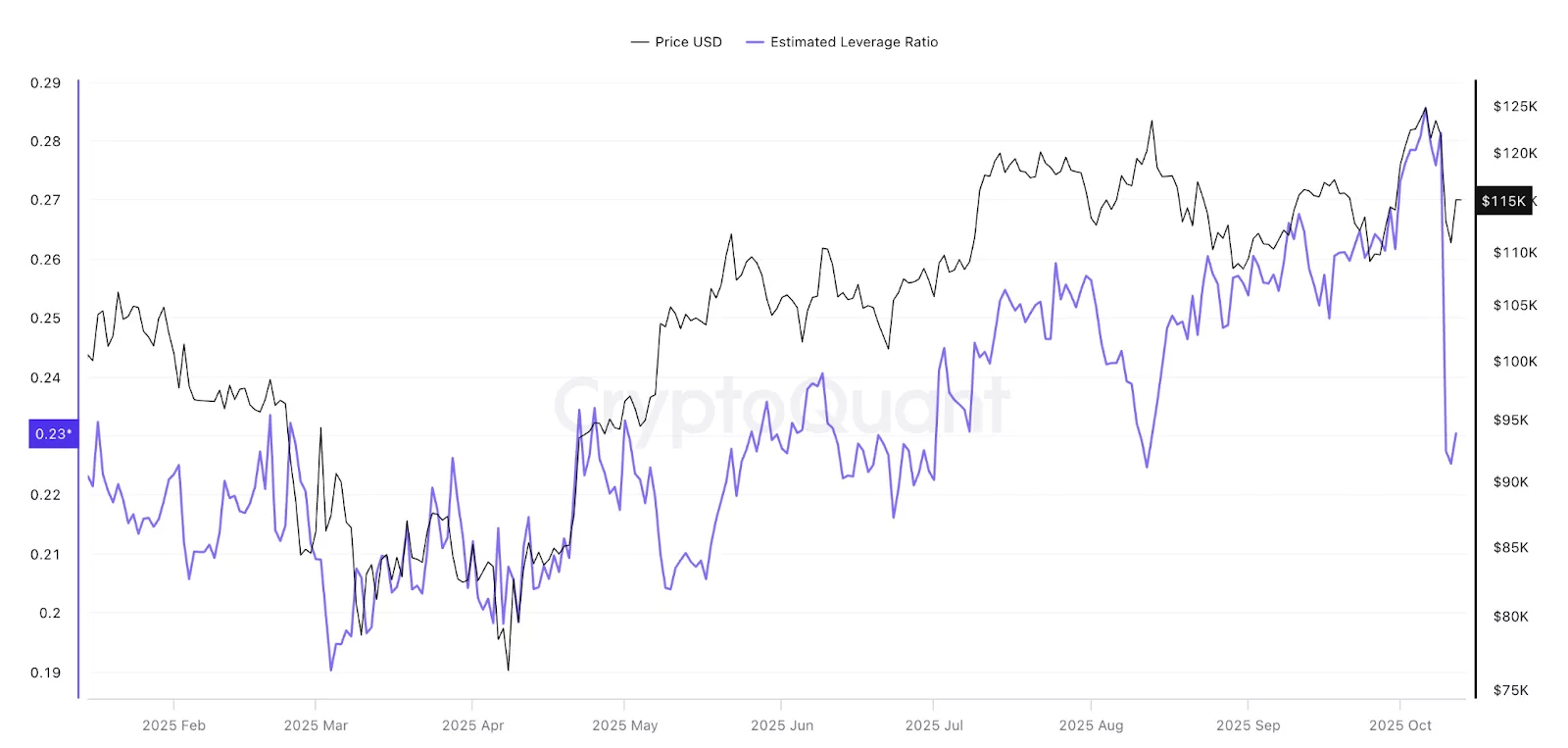

In addition, the BTC Estimated Leverage Ratio (ELR) — which monitors the leverage that traders are using relative to Bitcoin held on exchanges — has sharply declined to its lowest level since August. This decrease indicates that excessive leverage has been eliminated, lowering the risk of further liquidations and signaling a broad deleveraging across the derivatives markets.

Simultaneously, the Stablecoin Supply Ratio (SSR), which compares Bitcoin’s market cap to that of stablecoins, has dropped to its lowest level since April. A lower SSR indicates a larger amount of stablecoin liquidity is on the sidelines, possibly awaiting a chance to flow into the asset when confidence returns.

Historically, major deleveraging events have often preceded significant price recoveries, hinting that this recent reset may be a positive sign for the upcoming months. Meanwhile, strong capital inflows into the market are reinforcing this outlook.

Bitcoin leads $3b inflows amid Black Friday crypto crash

Last week, digital asset investment products registered US$3.17 billion in inflows, bringing year-to-date totals to a record US$48.7 billion. This demonstrates that even amid the volatility caused by US-China tariff tensions, investors are still channeling capital into the crypto market.

Leading the inflows, BTC attracted US$2.67 billion, raising its year-to-date total to US$30.2 billion. Following BTC, Ethereum (ETH) brought in US$338 million, while SOL (SOL) and XRP (XRP) saw smaller inflows of US$93.3 million and US$61.6 million, respectively. The drop on Friday resulted in limited outflows, indicating that traders viewed the correction as a buying opportunity rather than an impetus for panic selling.

Trading activity also surged to record levels. Weekly volumes for digital asset exchange-traded products (ETPs) reached US$53 billion, double the weekly average for 2025, while Friday’s daily volume peaked at US$15.3 billion, marking the highest single-day recording.

The robust inflows and heightened trading volumes signify that market participants maintain confidence in Bitcoin and the broader market, despite short-term fluctuations. Coupled with high liquidity, this may bolster the current recovery and establish the foundation for a more sustained rebound in the forthcoming weeks.